Claims-made vs. Occurrence

There are two basic forms of business insurance coverage to select from: a claims-made form and an occurrence form. The only difference between a claims-made and occurrence policy is how their coverage is activated.

Claims-made policy

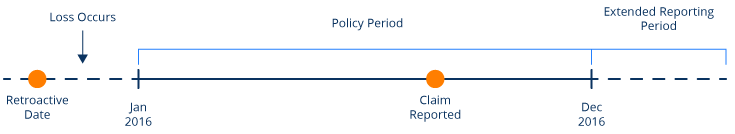

The claims-made form covers incidents that you report during the active policy period — or during an extended reporting period — and occur after a policy's retroactive start date. Claims through this form of coverage must meet both criteria for coverage to apply.

For example, a small business owner purchases a general liability policy on a claims-made basis. The policy is effective from January 1, 2016, through December 31, 2016, and has a retroactive date of October 1, 2015. A claim is reported during the policy period for a loss that occurred on November 10, 2015.

Since the incident was reported during the policy period and occurred after the retroactive date, the claim is covered. Claims-made coverage wouldn't apply had the loss occurred prior to October 1, 2015.

Extended reporting period

Also known as tail coverage, an extended reporting period is a provision on a policy that extends the amount of time you can report a claim after a policy's cancellation. Most policies typically include tail coverage, and the length of time varies depending on the carrier.

An endorsement may be added to your policy to lengthen the extended reporting period indefinitely and is commonly known as a supplemental extended reporting period (SERP). A loss must occur between the retroactive date and the end of the policy period for coverage to apply.

Occurrence policy

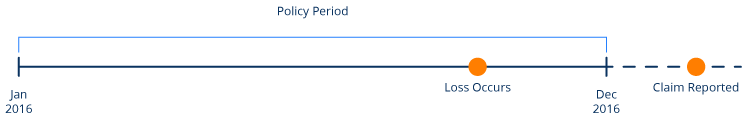

The occurrence form covers losses that take place during a specific coverage period, regardless of when an incident is reported.

For example, an electrician purchases a general liability policy on an occurrence basis. The policy is effective from January 1, 2016 through December 31, 2016. A claim is reported against the electrician in February 2017, for faulty work completed during the policy period in October 2016. The claim will be covered since the loss occurred during the policy period.

An occurrence policy is typically more expensive than a claims-made policy because there isn't a limit on the time a claim must be reported.

There's no advantage to having a claims-made coverage over occurrence coverage, and vice versa. It depends on how you'd like your coverages to be activated. Learn about which options are available for your business insurance policy by speaking with a licensed agent. You may also start a quote online.

More information